Stairpay founder, Floris ten Nijenhuis, talks to Shared Ownership Resources about tackling challenges to full home ownership.

Thanks for talking to Shared Ownership Resources. What first got you interested in shared ownership?

When I quit my job to start my own business, I wanted to empower people to own the home of their dreams. At the outset, I wasn’t clear exactly how I’d achieve this. But it was something which felt very close to my heart. Partly because most of my friends can’t afford to buy a home on the open market, unless they’re lucky enough to have parents who can help out financially. And I don’t think that many people are going to benefit from that kind of parental support going forward. It’s likely that most people in my generation won’t be in a position to give the next generation the financial assistance they’ll need to purchase a property.

It seemed to me that gradual home ownership is inevitably going to be how people buy homes in the future. Also, that it has to grow in order to give more people a chance to have the security of a roof over their head, and a place they can call home.

I started researching all the various gradual home ownership models, and found shared ownership. It’s the largest gradual home ownership scheme in the world, but no-one has heard of it. I have to admit, even I hadn’t heard of it. I realised that the shared ownership model doesn’t function as efficiently as it could. But the more I dug into the issues, the more I wanted to get involved and make a difference.

Tell me about Stairpay. What is it and how does it work?

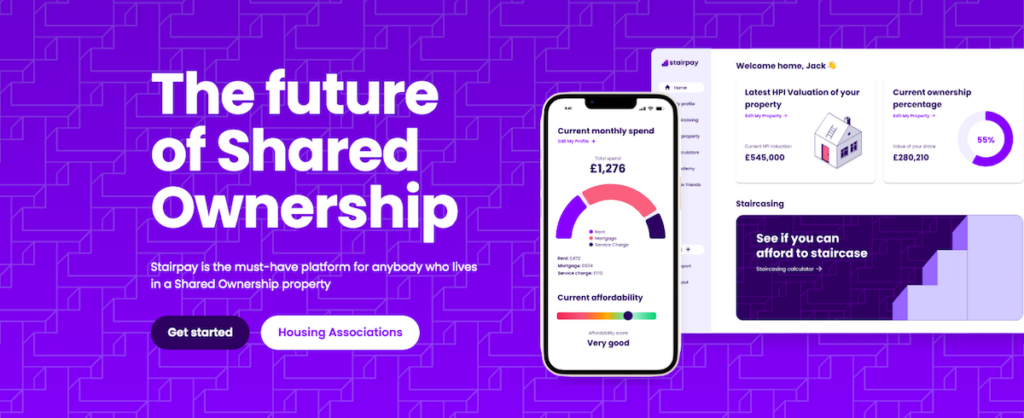

I launched Stairpay after researching the biggest issues faced by shared owners. People told us that staircasing (buying more shares) is confusing and hard to navigate, and that selling a part share can be slow and frustrating. So, as our first priority, we’ve focused on creating resources and tools to assist shared owners with these two major transactions.

We’ve developed technology to allow people to keep track of the likely value of their home, calculate the impact of staircasing on their monthly outgoings, and find the right time to staircase all the way to 100% – assuming that’s what they want to do. If staircasing is feasible, then we can connect people with trusted financial professionals to help them with that journey.

Our online tools automate key transactions such as 1% staircasing. And we’re using technology to simplify the resale process. For example, if shared owners have photos of their home, we can create a listing and send it to the major portals in seconds. One of my main goals is to make it easier to sell a part share, so it can be ‘recycled’ to help other people get onto the housing ladder.

Of course, any new technology takes time to build. So I always say that what we’re doing now is not what we’ll be doing in five year’s time. We’ve got ambitious plans to expand the support we offer. Right now, we’re working on scenario planning tools to help people informed choices – such as when the best time for them to staircase might be or, for those who haven’t bought a shared ownership home yet, whether it is a good idea for them to do so at all.

Does Stairpay offer financial advice?

Stairpay isn’t a financial advice service. However, we provide information, and projections, to help people talk through their options, perhaps with a partner initially, or a financial advisor when they’re ready.

Stairpay’s online Academy has detailed information on various considerations people might want to take into account in planning their finances. For example,

- how much their mortgage might cost;

- how much rent they’ll pay on the landlord’s share; and

- whether they’ll be liable for Stamp Duty Land Tax.

How do you vet the valuers and solicitors you work with?

Professionals who are inexperienced in shared ownership can cause delays, frustration and even additional costs. Not just for shared owners but also for housing associations. It’s not realistic for us to source the professionals we work with entirely from individual personal recommendations. This would be too time-consuming.

However, we’re taking advice from housing providers on the best and most efficient firms, based on their experience. We talk to potential partners about the volumes of shared ownership they deal with, and how they incentivise their teams to achieve good outcomes for shared owners. Over time, we hope to fine-tune this by collecting more feedback from shared owners as our business grows.

What advice would you give to anyone considering shared ownership?

My biggest piece of advice would be to sense-check your intentions, and financial plans, with a suitably qualified and experienced professional. It’s vital to understand the differences in costs between shared ownership and buying on the open market. Not just at the point of purchase, but over a longer time period – say, seven years or ten years. We’ve all heard horror stories of shared owners who end up in a bad financial situation. Unfortunately, it’s often down to weak advice at the outset.

It’s essential to be clear about the medium to long-term implications of the T&Cs in your lease contract.

Taking rent as an example, you need to understand how inflation affects your annual rent increase, and any implications if your rent goes up faster than your salary. If you’re clear about how and why your total housing costs increase over time, you’ll be better positioned to plan for this.

There are a number of leasehold consultations and reforms in progress at the moment. In your view, is there anything that could be done to improve shared ownership? If you were in government, what one SO reform would you prioritise?

For me, the number one thing that needs to improve is that it should be easier and smoother for people to forecast their pathway to full home ownership, and to be able to easily achieve that.

It’s partly about the quality of financial advice that people need to help them make informed choices and realistic plans, which we discussed earlier. But it’s also about eliminating unnecessary legal and admin costs. You shouldn’t have to pay thousands of pounds for conveyancing services in order to increase your mortgage and staircase. Unless the transaction is particularly complex – which it shouldn’t be!

It’s not necessarily the increased mortgage which prevents people from staircasing – given the cost is spread over 25 years or more. Sometimes, people simply don’t have enough spare cash to pay for a RICS valuation, legal fees and admin fees. We need to remove barriers to staircasing.

What next for Stairpay? What are your plans for the future?

We’ve got three related goals, which are intentionally broad.

- To allow shared ownership to reach its full potential.

- To improve public perception of shared ownership (which is only possible if it reaches its full potential).

- To double the number of people benefitting from the scheme.

In my view, improved data is fundamental to achieve these aims. The current lack of national data is a problem. But we’re collecting and analysing our own data to help make shared ownership a mainstream route into home ownership. Otherwise, large numbers of people will never be able to buy a home, and that can’t be right.

SPONSORED FEATURE

Featured image by Freepik

Be First to Comment