Is shared ownership rent affordable? The answer is complicated and depends partly on how you interpret the question…..

This is the second of a 2-part feature on shared ownership rent. In Part 1 we covered:

- How shared ownership initial rent is calculated

- Shared ownership annual rent reviews

- How RPI affects annual rent reviews

In Part 2 we’ll look at ongoing affordability of shared ownership rents, including:

- How the amount of shares held by the landlord affects ongoing rent affordability

- Whether shared ownership is cheaper than the private rental sector (PRS)

- Whether shared ownership is cheaper than buying outright

- Your options if you’re not happy with your rent review

On 22 October 2023, the Government published new rent reforms for shared ownership. The reforms aren’t retrospective so the information in this 2-part feature continues to apply, unless a lease specifies the new rent arrangements.

What difference does my initial share % make to my rent?

In Part 1 of this feature, we used Chloe as an example. We assumed that in 2012 Chloe bought a 45% share in a shared ownership home with a total value of £179,563 (the average property price in England that year). We tracked her rent increases using reported RPI up to 2023, then assumed that RPI was 2.5% every year for the remainder of her 25-year mortgage term.

Now let’s assume that neighbours Mikhael and Sahira purchased a 25% share, and a 10% share respectively. (For the purposes of this illustration, we’ll ignore the fact that it wouldn’t have been possible to purchase a 10% share in 2013. Recent reforms introduced 10% initial shares. The aim here is simply to examine what difference the size of the first share makes to ongoing rent affordability).

Annual rent review (with 7% rent cap)

In this illustration we’ve assumed that Chloe, Mikhael and Sahira’s housing association applied a 7% rent cap in 2023-24, due to the cost of living crisis.

As you’d expect, twenty-five years later, Chloe is still paying more than either Mikhael or Sahira. (We’ve assumed that none of them have staircased during this period). But what is interesting here is that Chloe’s rent on the 55% share still owned by the landlord has increased by £303, whereas Mikhael’s rent on a 75% share has increased by £413, and Sahira’s rent on a 90% share has increased by a whopping £496 in the same period.

It’s clear that the lower the initial share you can afford to purchase, the higher your exposure to annual rent increases.

Annual rent review (without 7% rent cap)

Some housing associations didn’t apply the 7% rent cap in 2023-24. This illustration shows how Chloe, Mikhael and Sahira’s rent would increase in this case.

Over a 25-year mortgage term, Chloe’s rent has increased by £333, Mikhael’s by £454 and Sahira’s by £545.

The shared ownership scheme requires shared owners to purchase the maximum initial share they can afford. But, if total housing costs (rent, mortgage costs, and service charges) already add up to 40%-45% in the first year then any significant increase in rent payable (or service charges) could push some shared owners over maximum affordability limits.

Is shared ownership rent cheaper than private sector rent?

This is a difficult question to answer. It depends which part of the country we’re talking about. It also depends on the time period over which we’re comparing private rental with the costs of shared ownership. Regardless, it’s essential to be aware that shared ownership may not stay cheaper than renting privately over the longer-term.

The private rental sector (PRS)

Of course, it’s essential not to underestimate the downsides of the private rental market, A lot of people enter shared ownership to escape the costs and insecurity that come with private rentals.

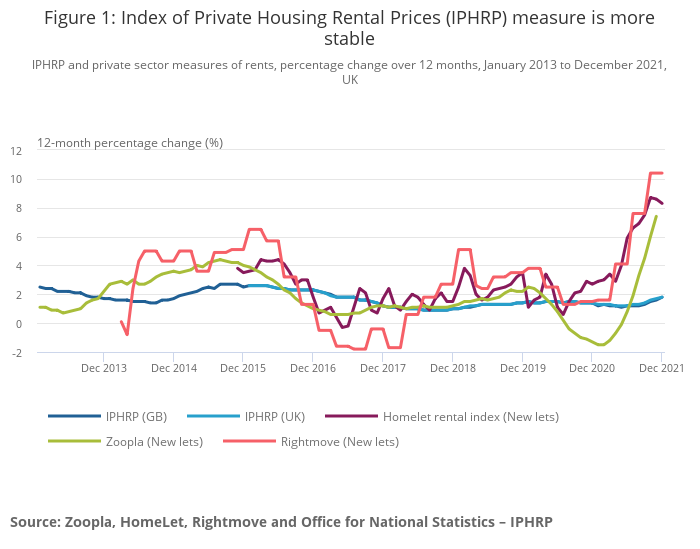

But open market rents can – and do – go down as well as up. This graph compares private rental prices per Zoopla, Rightmove and other sources of data). Each source of information shows a slightly different picture. But it’s evident that, regardless of the data source, private rents dipped in 2013, in 2017-18 and again in 2020.

Of course, national averages tell only a partial story. It’s quite possible that no private rental tenant had their rent reduced by their landlord. But private tenants do, at least, have the option of moving to a cheaper property if rents are falling in the area they want to live. Shared owners don’t have the same flexibility.

Private tenants don’t pay for repairs and maintenance

It’s also worth bearing in mind that private landlords should pay for repairs and maintenance. Whereas shared owners have to pay 100% of repair and maintenance costs, regardless of the size of their equity share. So comparing shared ownership rents and private rents is a bit like comparing apples and pineapples!

But there doesn’t seem to be any conclusive evidence that shared ownership rent remains cheaper than private sector rents over the long-term (particularly if you take service charges into account, where applicable). In fact, Savills research suggests that shared owners’ ‘contracted rent increases could mean their housing costs rise faster than the open market’.

Is shared ownership cheaper than buying a home outright?

Total housing costs include rent, mortgage and service charges. These will vary from home to home making it difficult to generalise. However, Savills’ research suggests that:

‘as the rent portion of shared ownership costs rises at a premium to inflation, monthly costs will rise faster than for full ownership. This ultimately leads to shared ownership becoming more expensive than full home ownership by the end of the mortgage term’.

Savills, Spotlight on Shared Ownership

Of course, a mortgage will eventually be paid off. Whereas shared owners who don’t – or can’t – staircase to 100% continue paying ever-increasing rent every year. (Raising some troubling questions about what happens if their income decreases drastically in retirement?

What can I do if I can’t afford my shared ownership rent increase?

This is another difficult question.

Generally speaking, contracts are legally binding. Homes England are clear on this point in their guide for housing providers.

‘Shared Ownership leases are assured tenancies and as a result are not subject to rent control under the Rent Act 1977. The setting of rents for Shared Ownership is a matter for the provider to agree with the leaseholder at the point at which the lease is granted’.

Homes England Capital Funding Guide , Section 4.1.1

‘Once the method of setting increases has been decided on and written into the lease, then the provisions of the lease will be binding’.

Homes England Capital Funding Guide , Section 4.2.1

Could housing associations impose a lower rent increase? It’s not at all clear. As shared owners would be unlikely to object, it’s possible that housing associations could voluntarily apply discretion in setting annual rent increases. However, this could potentially breach their grant funding conditions, or conflict with charitable objectives that require them to raise income for social rent homes.

Editor’s Note: New rent reforms announced in October 2023 make it clearer that housing providers have discretion to apply lower shared ownership rent increases in times of high inflation. However, the reforms aren’t retrospective, so current shared owners won’t necessarily benefit from the new rules.

Housing associations may offer support to shared ownership households on a case-by-case basis. But it’s hard to know exactly what such support might look like, or who would be eligible for support. One senior source in a large housing association told me:

“Most housing associations will be looking at some kind of relief to shared owners in financial difficulties. I’m sure there will be differences in approach – not least because many of us have different rent clauses in different leases”.

However, support on a case-by-case basis may not offer much comfort to shared owners. Some might already consider that their landlords has not been particularly supportive when it comes to bills for building safety remediation, and related costs such as insurance and waking watch.

One housing association, Orbit, suggest two options for shared owners who aren’t happy with their rent calculation: contact Citizen’s Advice or appeal to the Government’s First Tier Tribunal.

But it’s apparent from Orbit’s website that shared owners can dispute whether their rent increase has been correctly calculated, but not whether it is fair or affordable.

In conclusion….

The current cost of living crisis is concerning to a great many shared owners. Rents will increase substantially at precisely the moment household income is being eroded by unprecedented prices for energy and household essentials. In fact, it’s questionable whether annual rent reviews for an Affordable Homes Programme scheme should be pegged to a volatile (not to mention discredited) inflation measure such as RPI.

This feature has, of necessity, used indicative scenarios and various assumptions. But, of course, every household is different. A one-person household may face different challenges than a two-person household. Or a household with children may face different challenges than a household with no children.

SHAC (Social Housing Action Network) is currently campaigning against unaffordable rent increases for social rental tenants and shared owners. Click here for more information.

UPDATED 26 OCTOBER 2023 – illustrations amended to show effect of reported RPI to 2023, and the 7% rent cap.

Featured image: Lifestylememory – www.freepik.com

Thank you for this article!

I am a shared owner and my lease has a clause for rent to be increased by RPI + 2% every year based on RPI in November. So I may be looking at a rent increase of 19.7%!

Cannot believe this isn’t being covered more so in the media given the government talk of rent in the social rented sector being capped at 3, 5 or 7%.

Thanks for your comment, Owen. Yes, it’s hard to understand why there isn’t more media interest in the issues faced by shared owners, and their exclusion from proposed rent caps.

NB. You might be interested in this feature by i journalist, Vicky Spratt: https://inews.co.uk/opinion/inflation-linked-rents-could-be-one-of-the-biggest-housing-policy-mistakes-1827305

We bought a 25% share of a house under the then DIYSO scheme in 1994. We have never been able to afford to staircase. We have been refused help by our housing association for an action against our neighbours who carried out building work on their property without notice under the Party Wall Act and without Building Regs approval. Their work has damaged our house. The repair is not covered by the insurance provided by the HA as it has been caused by our neighbours. The HA have told us that we must take our neighbours to court and/or pay for the repairs ourselves. We have already spent almost £20,000 trying to put things right. The HA say that if we cannot afford to repair our house we will have to sell. I am 66 and have MS.

I am so sorry to hear about your experience. It sounds incredibly distressing.

Thank you for highlighting this. We are a family with three adult disabled children. Our shared ownership house has been adapted for wheelchairs. I am worried how we will be able to afford the rent when my husband retires. The rent was manageable when we bought the house 15 years ago, but each year the rent increases and now it is set to jump and become unaffordable. And with the increase in energy to keep three disabled adults warm, it is going to become very worrying. It seems that shared owners have been forgotten.

Thanks for your comment, Jane. Your situation sounds very worrying. Unfortunately, it does often appear that shared owners are overlooked..

Hello Sue,

Great article and great work overall! Thank you for the invaluable source of information.

I am a financial professional and I am just about to buy SO flat (yeah, my salary does not allow me to buy anything outright in London). As I started studying the subject, I discovered exactly same things as you write about – shocking truths about SO!

As for the affordability, in my case I buy 25% in London. I believe that the flat I buy would be already unaffordable for me in April 2024, slightly over 1 year after the purchase! This is due to the combination of the rent hikes (please note that I pay 1200 of rent for 75% as flats in London are expensive) as well as the increase of my mortgage interest. Should this be called an affordable housing at all?

Just 1 adjustment to your article from my side. The table ‘rent vs salaries increases’ is UNDERESTIMATED. The percentage does not add, it compounds! When you multiply the increases, the total increase of rents from 2012 to 2021 would not be 31.43% but in fact 36.17%. If we add the allowed RPI+0.5% increase for 2022 (for my flat it is 13.1% based on the September’s RPI) it would already be 54%!!! Considering salaries will probably not keep up with the inflation I can see a disaster looming on the SO market horizon. The 7% cap will not help a lot as it will still mean that the overall grow of the rent in 10 years is 45.7% and considering 3-4% projected median salaries grow they will barely cross 20%.

Thanks for your comments, Franek. And for the correction! Much appreciated. (I’ve updated the percentage rent increase accordingly).

Hello, I have found this article and part 1 incredibly informative. It’s clear to me that I cannot afford a shared ownership property in London or the Greater London boroughs as I have no clear pathway to a wage increase that would match the rental increases. It also fills me with anxiety to consider that each year I’d be waiting to find out how much more unaffordable my home would become.

Hello Yeni,

Thanks for taking the time to comment. I’m pleased these two articles were helpful. One of the problems with shared ownership – in my personal view – is that linking rent increases to RPI (on an ‘upwards only’ basis) makes it almost impossible to predict whether an SO home will stay affordable over the longer-term.

I hope you succeed in finding a home that meets your own needs.

Sue

Thank you so much for this article. I moved into a shared ownership property in Croydon nearly 2 years ago and the rent with service charge has gone up around £140 a month. It isn’t sustainable and I just wonder if I am going to be able to keep affording it.

I can’t understand how this can be allowed when we are responsible for all repairs and maintenance. This seems to get forgotten. Someone is making huge amounts of money from people who are struggling.

Additionally, the council tax bandings are higher compared to same value properties elsewhere, due to being new build.

Thanks for commenting, Mariko. Though I’m sorry to hear that you’re finding the rising costs of your SO home a challenge.

One of the problems with the SO scheme, in my view, is that the ‘affordability’ focus is very short-term. I’m currently writing a report which explores this aspect. Watch this space…

My HA for SO has just sent very condescending letter which basically says they are doing us a favour at capping it at 7% and they are not-for-profit. I am not sure how I am going to afford the increase as my pay is not rising but all bills are. I can’t afford to private rent a similar size home in my area and to top it all off we need to remortgage this year as our 5-year deal runs out. I’m terrified as the new build house which is now 10 years old is falling apart as poor quality building materials were used and things are just breaking.

Thanks for your comment, Emma. Though I’m so sorry to hear about your financial anxieties. Housing associations seem to talk a lot about being ‘not-for-profit’ – but it’s not always obvious what relevance that has to shared owners if their homes become increasingly unaffordable. I hope you at least manage to find a good remortgage deal.