Should shared owners be worried about Savills recent report Spotlight: Housing Association Finance? In the report Savills discuss financial pressures faced by housing associations, in part as a result of rent cuts for tenants and concerns over building safety. Savills propose a number of options to help the housing association sector balance their books. One of the options is selling off shared ownership portfolios.

Selling off shared ownership portfolios: are shared owners merely cash cows for the housing association sector?

The rationale for selling off shared ownership portfolios is that a stable but modest return of 2.75% per year on capital investment in shared ownership is lower than the average cost of borrowing. Savills suggest that:

‘Sale of these portfolios would allow this capital to be reinvested in assets of greater value to the business.’

Savills, Spotlight: Housing Association Finance, 18 May 2021

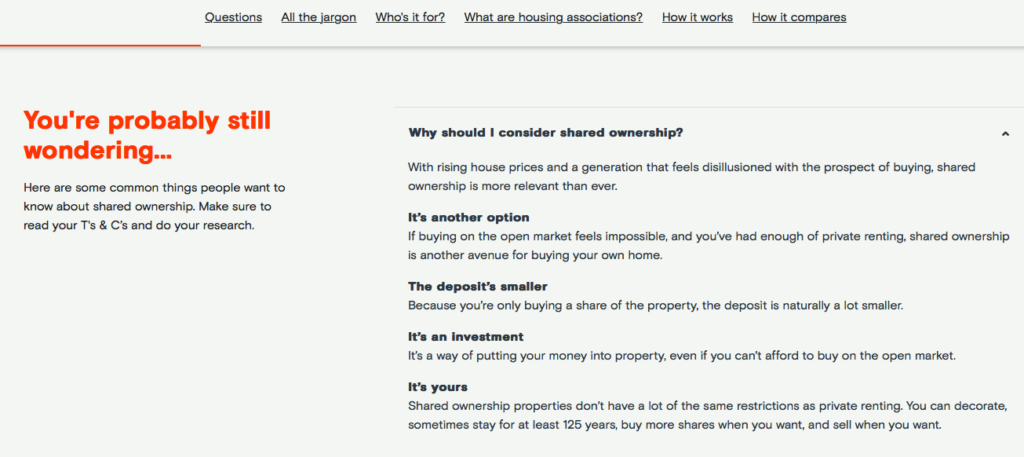

Marketing of shared ownership homes strongly implies that first-time buyers are investing in an asset. But claims such as: ‘It’s an investment. It’s a way of putting your money into your property, even if you can’t afford to buy on the open market‘ are disingenuous and misleading.

Shared owners are often surprised and distressed to discover that housing associations don’t appear to have their best interests at heart. For example, annual rent increases of RPI plus 0.5-2% contribute to the 2.75% typical return on shared ownership portfolios. Yet above inflation annual rent increases push the advertised dream of full ownership even further out of reach for shared owners, and can make it harder to sell their part share. The cross-subsidy model is a variant of robbing Peter to pay Paul, and a number of shared owners believe they are simply ‘cash cows‘ for the housing association sector.

Selling off shared ownership portfolios

Hyde have already partnered with M&G Investments, who have made a £61 million purchase of 422 shared ownership homes in London and Kent.

Peter Denton, Chief Executive Officer at Hyde, says: “Funds received from the shared ownership properties will then be reinvested in new homes, with the partnership model offering a long-term objective to deliver a net additionality of shared ownership properties in and around London”. He adds: “We owe it to our future customers to continue to build new homes”.

But this focus on future “customers” appears to be at the expense of existing shared owners. Mr Denton says: “We will continue to manage and maintain all the properties for the long-term, and customers will not see any changes to their shared ownership leasehold agreements, rental arrangements or their frontline services.” This from a housing association which scores 1.3 out of 5 from 122 reviews on Trustpilot.

There is clearly an urgent need for reform with a strong focus on improved long-term outcomes for shared owners. However, it’s hard to see how a strategy to fund and build even more shared ownership properties via selling existing shared ownership portfolios, will do anything other than exacerbate problems faced by shared owners. Increasing numbers are already trapped on the first rung of the property ladder. Is there a risk they’ll become increasingly vulnerable to the need of institutional investors to generate good returns on their own investment in peoples’ homes?

Housing associations need more cash. But are they balancing their books at the expense of shared owners?

HQN CEO, Alistair Mcintosh, takes a close look at Savills’ proposal to sell off shared ownership portfolios in the video below. As he points out:

But that dissatisfaction arises directly from what he describes as: “the schism, or a chasm as it were, between the marketing and the reality”.

Shared owners were promised affordable housing and a ‘foot on the property ladder’. They placed trust in a Government-backed scheme: an affordable homes scheme specifically targeted at financially vulnerable first-time buyers, and delivered by seemingly charitable entities. As a consequence of that trust many shared owners now face dire, intractable, life-changing financial problems.

Yet the housing association sector’s response to queries and complaints from existing shared owners frequently veers between “caveat emptor” and “no comment”. From the perspective of shared owners, selling off shared ownership portfolios looks like a strategy to evade accountability whilst generating even more income from their financial misfortunes.

Have regulators failed shared owners?

Selling off shared ownership portfolios would raise many, many questions about regulation of social housing marketing and delivery. The fire safety scandal has thrown into stark relief open market regulatory failings. And shared owners face even more problems than leaseholders generally due to factors including:

- 100% liability for all charges regardless of the size of the % share purchased;

- vulnerabilities of assured tenancy tenure prior to staircasing to 100%;

- statistical unlikelihood of staircasing to 100%;

- over-charging for services;

- annual rent increases at rates in excess of inflation; and

- restrictions on subletting.

Housing associations appear to have little inclination to accept valid critique or to identify meaningful responses to fundamental weaknesses in the shared ownership model. Alistair Mcintosh discusses the temptation for the housing association sector to simply take advantage of “an opportunity to move those customers on somewhere else”. That somewhere else being institutional investors.

Such investors will have no compunction about squeezing even more cash out of shared owners to improve on existing 2.75% returns. As Mr Mcintosh says: “there are probably willing buyers who could do better with these portfolios; it’s index-linked and maintenance lies largely with the occupant of the shared ownership property“. Institutional investors will argue that it is their legal duty to maximise financial returns from shared ownership homes.

If the public can’t place trust in housing associations the future looks bleak indeed

Mr Mcintosh highlights potential reputational damage arising for housing associations from the strategy of selling off shared ownership portfolios.

But the potential for reputational damage surely extends not only to housing associations but also to regulatory bodies who appear to have done little to protect shared owners: the Regulator of Social Housing clearly, but also the Housing Ombudsman, the Charity Commission (given exempt charity status afforded to housing associations), the Advertising Standards Authority and National Trading Standards.

If the public can’t place trust in housing associations for a secure and affordable roof over their head the future looks bleak indeed.

As someone at the start of the shared ownership journey I’ve spent the last few weeks looking at the lease I’ve been sent with fresh eyes after reading this. For anyone already in the ‘system’ I’d urge you to look again at your own lease with the eye of a corporate entity that may be interested in purchasing your home from your housing association.

The clauses for service charges, and admin charges, rarely have a cap. Where housing associations use these clauses to make large to us but relatively small corporate gains to reinvest in future developments, the kind of companies who may purchase your home will have money hungry shareholders and pension fund holders to satisfy. With that kind of pressure they will be looking at your lease to see where they can improve their return at your expense. Where you see ‘reasonable’ on your lease with relation to charges they will see ‘opportunity’ and will charge you as much as they can get away with.

I have discovered a fair amount about the housing association sector in the last 2 months, and have found that the one I am dealing with is acting without any oversight on the development I’m purchasing one because it’s not funded by Homes England. They’ve made a new corporation of 4 HA’s to build new thousands of new houses. Homes England were hamstrung. They can only ‘regulate’ developments funded by themselves. Without external accountability there will be even less responsibility for corporate entities who may not even be part of the Housing Ombudsman scheme. I believe it could be a case of ‘better the devil you know’ with regards to this issue and that shared owners should strongly oppose any sell off of their homes.